Gold has long been regarded as a symbol of wealth and power, but its significance goes beyond mere ornamentation. As an investment, gold offers a unique blend of stability, security, and potential for growth. In times of economic uncertainty, gold often shines as a safe haven asset, making it an essential component of a diversified investment portfolio. This article explores the various facets of gold investment, from its historical importance to the different ways to invest in gold today.

Why Invest in Gold?

-

Inflation Hedge

- Gold historically maintains its value during inflationary periods, making it a reliable store of wealth.

- As the purchasing power of paper currencies declines, gold's value often rises, protecting investors from erosion in their real wealth.

-

Safe Haven Asset

- During economic downturns, financial crises, or geopolitical instability, gold tends to retain or increase in value.

- Investors flock to gold during uncertain times, driving demand and prices up.

-

Diversification

- Gold's price movement often inversely correlates with traditional assets like stocks and bonds.

- Including gold in an investment portfolio can reduce overall risk and enhance long-term stability.

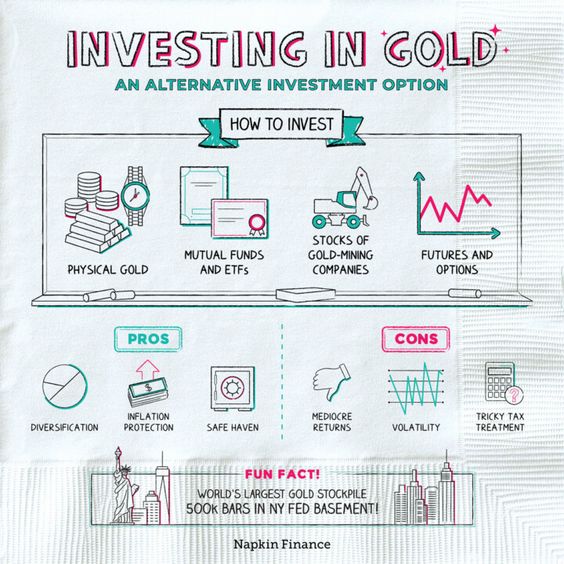

Ways to Invest in Gold

-

Physical Gold

- Gold Bars and Coins: These are tangible assets that investors can hold, offering direct ownership and the ability to physically store wealth.

- Jewelry: While less common as an investment, gold jewelry can be a dual-purpose asset—both decorative and valuable.

-

Gold Exchange-Traded Funds (ETFs)

- ETFs allow investors to gain exposure to gold without the need to store physical assets.

- These funds track the price of gold and can be traded like stocks, offering liquidity and convenience.

-

Gold Mining Stocks

- Investing in companies that mine gold provides leverage to the price of gold. As gold prices rise, mining companies' profits can increase significantly.

- This option comes with higher risk and reward, as company performance depends on factors beyond just gold prices.

-

Gold Futures and Options

- For more experienced investors, gold futures and options offer a way to speculate on future gold prices.

- These instruments allow for leverage but come with higher risk and complexity.

-

Digital Gold

- Newer platforms allow investors to buy and hold fractional shares of gold online.

- Digital gold offers the benefits of physical gold ownership without the need for storage and security concerns.

Factors Influencing Gold Prices

- Global Economic Conditions: Gold prices often rise when global economies are in turmoil.

- Interest Rates: Lower interest rates can drive investors toward gold, as the opportunity cost of holding non-yielding assets decreases.

- Currency Fluctuations: Gold often inversely correlates with the U.S. dollar. A weaker dollar typically boosts gold prices.

- Supply and Demand: Gold mining production levels and consumer demand, particularly from countries like China and India, can significantly impact prices.